CERR has updated the rating of the most active banks in Uzbekistan. What has changed?

27.09.2022

27.09.2022

31931

31931

The largest increase in activity was shown by Xalq Bank, which immediately rose four lines in the overall rating from 16th to 12th place. Ipoteka Bank shows a decrease in activity for the 3nd quarter in a row and shifted from 5th to 8th place. Asaka Bank closes the rating of large banks, which continues to hold the last line in its group.

The Center for Economic Research and Reforms (CERR) has updated the "Bank Activity Index" for 31 commercial banks of Uzbekistan. On its basis, a quarterly rating of banks is compiled.

The study is conducted to monitor changes in the share of the private sector in banking assets as well as to assess the effectiveness of reforms and transformation processes in the country's banking sector.

As of September 1, 2022, the assets of the banking system of the Republic amounted to 532.1 trillion sums (an increase of 31.8% by September 1, 2021), liabilities – 455.7 trillion sums (+34.3%), loans – 355.5 trillion sums (+15.7%), deposits – 205.7 trillion sums (+56.7%). Currently, 57.8 thousand people work in the banking system.

In the study, banks are divided into two groups — large and small. A rating was compiled for each of the groups. At the same time, the group of small banks includes banks operating only in Tashkent (or only in one region).

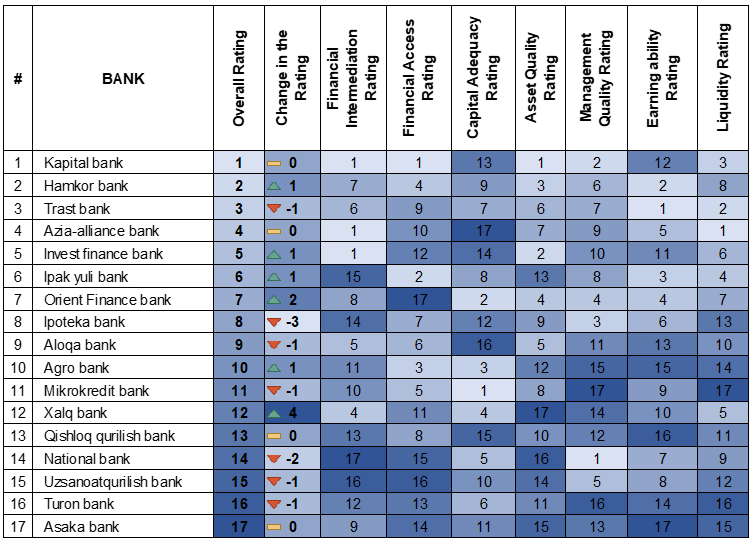

Rating of activity of large banks for the 3rd quarter of 2022

Kapital Bank once again topped the rating of activity of large banks in the 3rd quarter of 2022. Hamkor Bank is next to him and Trast Bank is in third place, which dropped by one point.

Among the 17 large banks, Hamkor Bank has demonstrated moderate growth for the second quarter in a row, the bank has again risen by one line, taking 2nd place in the overall rating. The bank improved its capital adequacy results by 3 points and showed good results (+1 point) in financial accessibility, asset quality and management, as well as liquidity. At the same time, the rating results show that the bank should pay attention to the indicators of financial profitability, which remained unchanged.

Of the large state-owned banks that are in the process of transformation, Ipoteka bank lost three points at once and dropped to the 8th line of the rating. This bank has shown a decline in financial intermediation for the 2nd quarter in a row, which indicates the need to further increase the ratio of term deposits to loans, increase the efficiency of using funds received from other banks and financial institutions as well as obligations to the Ministry of Finance. A low indicator of the bank's financial liquidity indicates a decrease in the ratio of highly liquid assets to total assets.

In the overall rating of large banks, Asia Aliance Bank and Qishlok Qurilish Bank retained 4th and 13th place, respectively.

Despite the fact that Asaka Bank's financial intermediation and capital adequacy indicators have improved somewhat, this bank still occupies the last place in the overall rating.

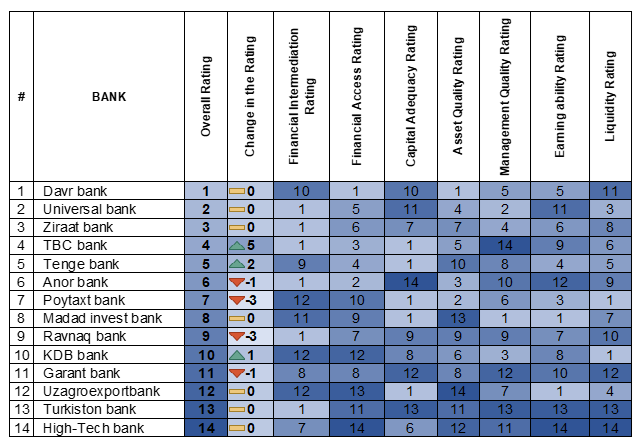

Rating of activity of small banks for the 3rd quarter of 2022

Among 14 small banks, the Top 3 remained unchanged, so in the 3rd quarter of this year, Davr Bank, Universal Bank and Ziraat Bank hold the lead, having again strengthened their positions.

In this quarter, a very impressive leap was made by Tibisi Bank, which immediately rose five lines in its group. In particular, it has significantly improved the indicators of financial capital adequacy (+7) and asset quality (+6), which indicates the active work of the bank with the population and business representatives. The analysis showed that compared to the previous quarter, the bank's capital adequacy ratio is 2.3 times higher than the minimum norm of the Basel Committee (norm 0.13). In addition, the share of problem loans of Tibisi Bank decreased significantly to 3% compared to the previous quarter, which is lower than the average for the banking system (5%). However, the rating results show that the bank should pay attention to management efficiency and profitability.

In Uzbekistan, the banking system is still in the stage of active development and is preparing for the privatization of state-owned banks. The state's share in the banking sector is scheduled to be reduced from the current 82% to 40% in 2025.

The ongoing changes and the growth of the competitive environment in the banking system indicate the need for further development of private banks, in particular by searching for innovative financial products and services.

To get a full report, methodology and detailed information about the study, please contact the Center for Economic Research and Reforms.

Sector for the study of the banking and financial sphere and the capital market | tel: (78) 150 02 02 (410)

Public Relations and Media Sector | tel: (78) 150 02 02 (417)